Later Living Market – July 2023

Senior Living Market Overview

- Knight Frank reported that there were over 8000 new senior living units created in 2022, consisting of more than 145 developments, a 6.4% increase compared with 2021.

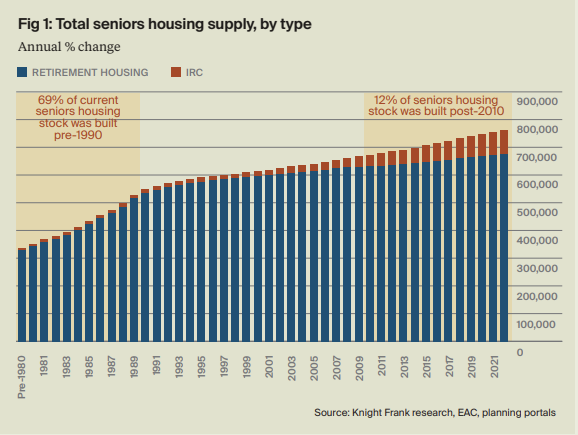

- Only 12% of the senior housing stock in the UK has been built after 2010, with 69% built before 1990, indicating a significant amount of older and outdated properties.

- Knight Frank have forecast an increase of 91% in terms of the total number of private senior rental units by 2027.

- The Office of National Statistics have projected an increase of 4.2 million seniors by 2040, reaching a point where 25% of the population will be aged 65 or older.

- Integrated Retirement Communities (IRCs) accounted for 58% of all new seniors housing units delivered in the UK last year and are poised to remain the primary focus for senior housing delivery.

Market Challenges

Challenging development conditions have been brought about by increased construction costs, limited labour supply, and planning uncertainty. Additionally, the persistence of high inflation has further compounded the operational challenges with rising costs. According to the BCIS, build costs experienced a significant surge of 8.7% in the previous year, with material expenses witnessing a rise of 10.9%, and labour costs escalating by almost 5%.

The 2022 Mayhew Review that was published to independently verify the magnitude of the housing predicament suggested the government to set a seniors housing target of 50,000 units annually until 2040 to meet the growing demand.

Given that just over 8000 new senior living units were created in 2022, at the current rate there would be a shortfall of over 700,000 by 2040.

Paul Brundell, CEO at Kosy Living said:

"Kosy Living’s commitment to help meet the housing needs of the growing senior population remains unwavering. Our focus on later co living and integrated retirement communities will pave the way for sustainable and innovative senior housing solutions.

Senior housing is not only crucial for the growing 65+ population but also presents a feasible solution to the broader housing crisis. By providing attractive and viable alternative residential options for retired and semi-retired individuals, we have the potential to release millions of family homes back into the mainstream housing market.”